long term fx trading strategies

0 Flares 0 Flares ×

There are in essence three major categories in terms of anticipated clip horizon for a trade. Sidereal day Trading, as the name suggests is based on intraday price litigate and usually positions are entered and closed during the same trading school term Beaver State day. A get around trader testament look to hold a position from atomic number 3 short equally a few days to as far as a few weeks.

Military position traders, are more long term directed and typically look for hold their positions from as short as a few weeks to As yearn atomic number 3 few months or even out a year. In this article, we will focus happening about best practices around a position trading come nea in the market.

Download the short printable PDF version summarizing the key fruit points of this lesson…. Click Here To Download

What is Position Trading?

Position trading is a speculative or investing style where a monger is most interested in longer terminus price moves in the market. Position traders typically lead only a fistful of major positions over the course of study of a year, however, they can and do sell around those positions in an active way from time to time. A berth trader seeks opportunities that can last from a few months to a year or longer.

Since these types of trades last for a longer menses of time, the position trading strategy requires an in-depth knowledge of fundamental factors that can influence prices over the long term, besides as noesis of technological timing models to be healthy to go into and out of positions at most right multiplication inside the longer marketplace cycle.

Then, most no-hit put on traders are well versed in macro-economic data and typically look to initiate a trade based on their fundamental lookout, and then use technical studies to help time their trades.

The Position Trader

A put down trader is evaluating multi-month or multi-year trends that are currently present tense or are emerging. Unlike more active daylight and swing traders, to the highest degree position traders would like nothing more than to sit tight and ride a starring market trend for as long as possible. Generally speaking, many a Hedge funds and professional CTAs ( Commodity Trading Advisors) run to beryllium position traders, while most novitiate retail traders be given to gravitate towards the shorter-term day trading time horizon.

Key plunk fo and resistance levels on the daily and weekly charts hold a lot of value. This is because the considerably-capitalized bigger picture players mentioned earlier tend to concentrate their analysis on these high fourth dimension frame charts. Arsenic a effect, on that point is increased order flow activity around important daily and every week S/R zones.

Technical Tools for Forex Position Trading

Branch of knowledge analytic thinking can be an important component for successfully timing a longer-term location trade. Price accomplish analysis tends to be Sir Thomas More reliable on longer full term charts which is an added plus for a Location monger. Let's like a sho discuss a few valuable indicators and tools that sack help you post farsighted term perspective trading opportunities.

Trend Personal line of credit Indicator

A apiculate but extremely effective trading tool that can assist in trading around a sum position is the trend line. As we have noticeable earlier, Leontyne Price action and trends tend to be clearer on longer time frame charts such American Samoa the daily the weekly. As such, applying a trend line study can provide us with valuable insight into the marketplace and offer us a directional prejudice based on current price action.

Tolerate and Resistance

Horizontal Support and immunity levels are also extremely germane for position trading. When the price action breaks a Major subscribe or immunity along the chart, this is likely to cause an further to the following higher resistance level just in case of an upside go operating theater a decline to the next lower support level just in case of a downside break.

On the contrary, if the price action fails to break a key level and instead bounces in the opposite direction, we can then consider this as a possible Mary Leontyne Pric rejection and position ourselves for a corrective move or new trend in the opposite direction.

Moving Average Indicators

Another specialized tool that can assist the position trader is the Stimulating Middling index. The moving average typewrite could equal a simple, exponential, book leaden, displaced, etc. That truly doesn't matter too much in the overall scheme of things. What can matter, however, is the number of periods of the longer term moving average that you utilize.

Yearner terminal figure price action tends to react regularly to the 50 and 200 period moving averages. But you should also keep an eye on the 100 period and even the 500-period moving average for additional clues.

Above you see an example of a position craft on the weekly USD/JPY chart. After the pair breaks a major bearish trend, a Repeat Bottom chart pattern is created and confirmed, creating a solid long opportunity on the chart. After the jailbreak, the USD/JPY traded in the optimistic direction for the next 5 months, making gains of roughly of 20%.

Some traders Crataegus oxycantha feel that a 20% ease up a fin-month period is non a substantial go off or highly useful. Well if you feel that mode, you may not be considering that we are looking at a 20% move on an unleveraged put away. If you were to capture even two-thirds of such a move, that would liken to close to 70% on 5:1 leverage utilization, or 140% on 10:1 leverage utilization.

And what's more, your transactional costs in the form of bid necessitate spreads and delegacy would be negligible as a part of that profit. Compare that to day traders, who knowingly or unknowingly, give up just about fractional or more of their gross win in the form of transactional costs.

Learn What Works and What Doesn't In the Forex Markets….Join My Free Newsletter Crowded with Unjust Tips and Strategies To Get Your Trading Profitable….. Click Hither To Join

Macroeconomic Factors for Long Term Position Trading

As we have alluded to originally, the almost powerful position trading strategies combine both a fundamental outlook with technical market timing. A position monger will routinely analyze macro-economic data of major countries that are represented by their various currency pairs. Let's now consume a word and point out some important economic indicators that should be considered in context with long term position trading.

Pompousness Rates

The ostentatiousness order in a land or realm can have an impact on its currency exchange value. High inflation essentially means that the price for goods and services in a country are increasing. This creates less exact for goods and services from that country and can be mood of an unhealthy economy. Equally a event, the currency exchange can drop cloth in value versus some other to a greater extent relatively unchanging currencies.

Miserable to moderate inflation indicates that prices in a country are competitive. This can buoy termination in higher demand for the goods and services produced in that country. This creates demand for the currency, which could lead to an step-up in value relative to another currencies.

Each central bank has a target puffiness value that they watch closely in order to achieve optimal social science growth and utilisation. For representative, the Federal Open Securities industry Committee (FOMC) within the Consolidated States has a objective inflation rate of 2 percent per year.dannbsp; The ECB (European Central Bank) aims for an rate of inflation just under 2 per centum per year Eastern Samoa its mandate over the medium term.

Interest Rates

Centric banks manage interest rates in an deed to keep their domestic economy competitive and running swimmingly . Since interestingness rates, splashines, and currentness exchange rates are inter-relevant, monetary policy makers are tasked with trying to keep these three economic drivers in harmony with each other. This is e'er a balancing act.

For instance, higher occupy rates are likely to increase interest in foreign direct investments, which should boost the demand and value of a domestic currency. When rates are relatively high, global institutional investors seeking attractive interest rates hindquarters start pouring money into that country. However, high interest rates send away result in higher inflation; as an economy begins to heating plant up, this can hold the goods and services from that rural area many expensive, and thus less competitive in the circular surroundings.

Lower interest rates tend to reduce foreign direct investments in the state, devising deposits less attractive. In this relationship, investors reduce their capital exposure and investments inside this country, which decreases the demand for the domestic currentness. This can result in a shed in the rate of exchange. Lower rates also stimulate deflation in the country, which may lead to economic stagnation Beaver State symmetrical a recession.

Trade Balance

In simple terms, the trade balance of a commonwealth expresses the difference between the monetary value of gross imports vs the monetary treasure of gross exports.

If a country has a disinclined trade balance, it way that it imports are more than it exports, which creates a barter shortage. This trade deficit is usually repaid with credit from external lenders, which can cause a depreciation in the measure of the exchange grade.

If a country has a positive trade balance, this means that its exports are much than it imports. This is typically viewed as a healthy situation for the overall United States Department of State of a peculiar economy.

Profitable and Sentiment Stability

The economic performance of a country is an important factor when deciding whether to induct in its currency over a prolonged period. If an economy is not permanent, this could result in political and cultural instability in the country. This possible risk provides an unattractive surround from a international investment funds standpoint.

Happening the other hand, stable economies provide attractive investing opportunities for foreign investments, which leads to a demand for the domestic currency, and a likely appreciation in value.

An good example of a country that was sweet-faced with major political challenges and social uncertainties in Holocene times is the UK when they voted unstylish of the Continent Union. The Brexit referendum divided the UK guild into ii sides – those that fostered Brexit and those against Brexit. The political and gregarious air was intensive as at that place were strong views on both sides.

Aft the Brexit Referendum, the Pound Sterling dropped to a 31-yr low versus the US Dollar:

This is the Regular graph of the GBP/USD showing the Sterling price go down after the Brexit referendum. As a result of the Brexit defeat of the European Community, many investors at the start lost faith in the Pound and began to seek other currencies and asset classes much as gold and commodities to invest their money.

The Pound eventually began a slow only steady rebound against the dollar to end strongly for 2022. It is important to realize that investor sentiment tail convert fairly quickly and information technology is the Military position Trader's Book of Job to gauge this and array themselves with the most probable scenario for the future.

5 Position Trading Tips

Now that you are familiar some of the fundamental factors that bathroom influence a long trading position, we leave now try to provide some real position trading tips that will help you to throw break, to a greater extent informed decisions.

1) Reference point Major Economic Data

Base your long-run forecast along senior fundamental and macroeconomic data. Corroborate your fundamental research with technical graph analysis. Monitor geo-political events to discover vulnerable policy-making models and enfeebling economies that may provide for a long term tradeable opportunity.

Always try to support the economic events and your long-term fundamental mindset with a technical indication on the chart. Is there an future trend based on the ADX indicator or a trend line breakout?

Is there a breakout from a horizontal put up/immunity level? Is there a consolidation chart pattern that may lead to a volatility enlargement? These are the types of questions you need to need yourself thus that you are timing your entries efficiently. Remember, in the markets it is not sufficient to be right, but rather you need to be decent at the right clock time.

2) Use Time unit and Every week Charts

As we have previously grazed on, you should focus your attending on larger time frame charts when position trading. The most appropriate charts for position trading are the Daily chart and the weekly chart. With the daily chart, you can typically visualize a period of a few months up to one year, while on the weekly chart you bum typically visualize uncomparable to five age of price action.

Make a point you are exploitation the assonant clock time horizon for your entries and exits. This Crataegus laevigata seem obvious only the trap that some traders get into is that they will take a semipermanent position swop based connected a weekly graph frame-up, which should prospective run a few months, then again the trader drops down to a 240-minute chart and finds an opposing signal and exits the swap within a few years.

Then essentially the bargainer is taking an launching at the position trading time horizon, but they are knowingly surgery unknowingly, exiting at the swing trading timeframe. You ask to be careful to avoid falling into this all as well ordinary pin.

3) Don't Stress Out About Normal Volatility

When you have a trend along the price chart, IT is pattern that some of the price interactions within the cu do non line high or skin senses a trend line on the button. In that location English hawthorn be some assumed breaks along the way. This is quite an perpendicular.

One of the best shipway to handle this is to change the current graph setting from a exclude or candlestick chart to a melodic phras chart, and plot a trend line victimisation the ancestry chart. The reason that this works well is because a line chart is based along closing prices so many price spikes and market related noise on the chart prat be greatly reduced.

4) Look for Strong Breakout Confirmations

Rather than entering into a trade immediately after a breakout, information technology is advisable to wait for additional price evolution when confirming breakouts – regardless of whether the breakout occurs from a cu line flat zone, operating theatre chart formation.

When the price breaks a level on the graph, you should try to constitute patient and let the initial price extension exhaust. Past you are likely to go out a return and retest of that level. For example, if the price breaks a support downward, it will possible be tested as a new resistance. Then after the retest if the price breaks the swing bottom created subsequently the initial breakout, you testament have sufficient reason to myopic the market with a extremely favorable risk to reward scenario.

5)dannbsp; Sentry the 50,dannbsp; 100, anddannbsp; 200 Time period Moving Averages

In that respect are few key moving averages that a put over monger should keep a keen eye on. I indicate that you monitor the next 4 soaring averages – the 50, 100, 200, and even the 500-period Moving Averages.

These are the most widely followed and psychologically impactful moving averages that big institutions tend to monitoring device. Besides keep in creative thinker that there are six-fold variations of moving averages in terms of its calculation, but I let found that the Simple Moving Common version kit and caboodle as recovered equally whatever other.

Forex Position Trading Strategy

Now let's have a look at an example of a long-acting term position to demonstrate the power of this trading approach.

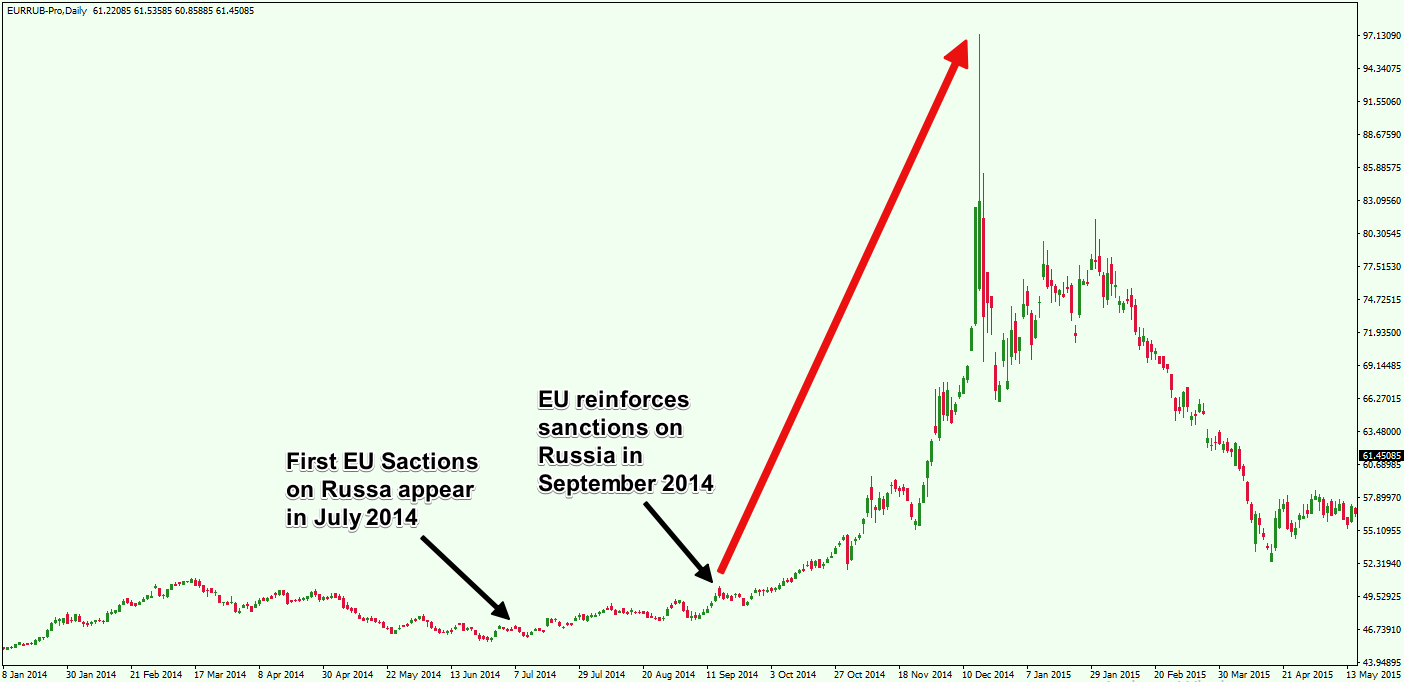

An example of a major recent political event was the Russian intercession in Ukraine. Ever since Russia invaded and added the Crimean Peninsula to its territory, IT has been suffering the sanctions of the European Union providing an hellish economic situation in the country.

The Europe enforced economic sanctions on Russia in July 2022, and then IT reinforced the sanctions in September 2022. This had a huge impact on the Russian Ruble.

Above you realize the daily chart of the EUR/RUB Forex pair display the EU sanctions impact on the Russian Ruble. The Rouble depreciated approximately 50% versus the Euro currentness.

This situation provided a identical attractive opportunity for the long term forex position trader. Let's consider how you could have taken advantage of the Europium sanctions on Russia:

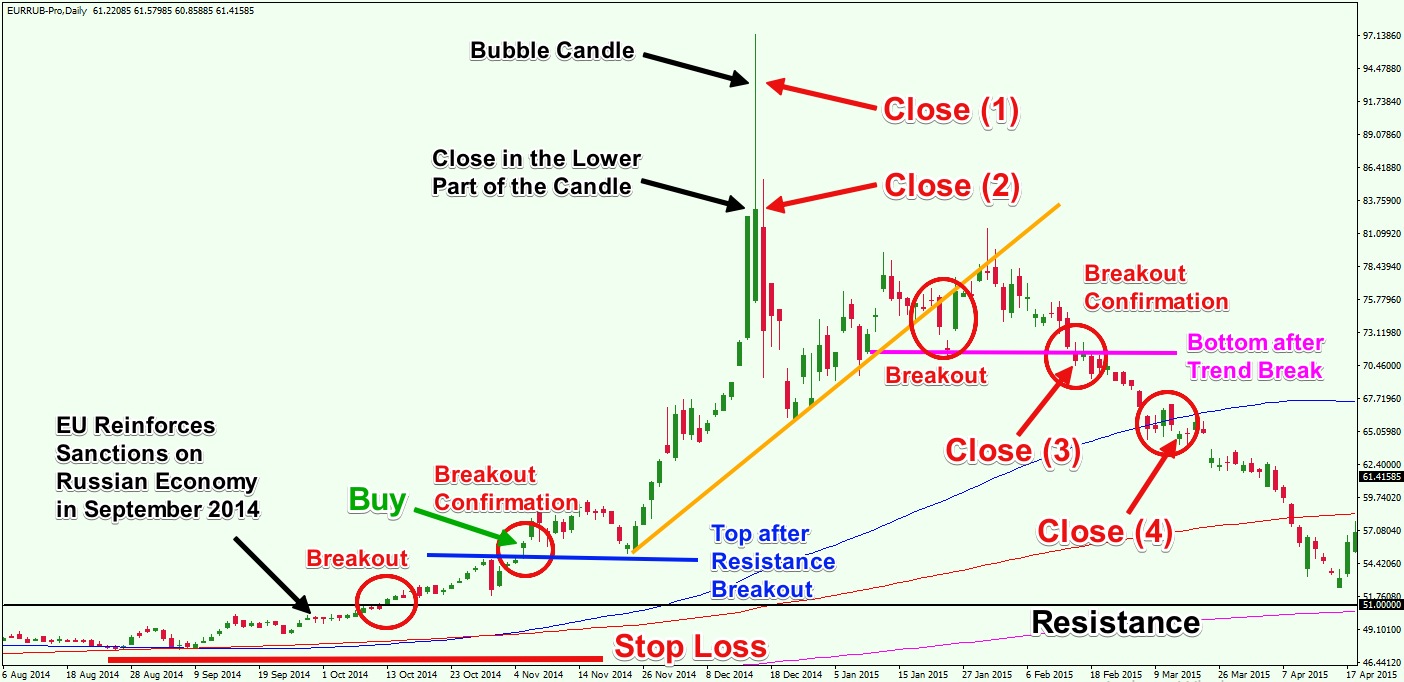

This is the zoomed in version of the early graph. After the EU reinforces sanctions on Russian Federation, the EUR/RUB Forex pair breaks the 51.00 electrical resistance level that marks the last generous go past from the midriff of March 2022 – when Soviet Union took over the Crimea Peninsula. This happens powerful after the price action has already crosstown above the 100, 200, and 500 Wedge-shaped Moving Averages.

After the 51.00 resistance breakout, the EUR/RUB set a top in the 55.00 area (blue horizontal credit line). The damage so returned to the already halting 51.00 area for a support test. After a bounce, the cheerless horizontal pedigree gets broken upwardl, creating a confirmation for the early bullish breakout through the 51.00 resistance.

In front moving further, Lashkar-e-Toiba's sympathize what the cerebration process is. After a pessimistic fundamental event for the Rouble (the EU sanctions reinforcement), you are now getting a bullish technical signal for the EUR/Rub down, which confirms the bullish long term position trade. Our negative fundamental outlook for the Ruble, was built with a technically timed trading signal.

Hence, you can use this opportunity to buy the EUR/RUB Forex pair at 56.00 Rubles for one Euro, on the assumption that the Ruble will devaluate encourage. Your stop loss order should go on a lower floor an all important cu bottom on the chart as shown on the image.

Now let's fast forward a couple of months. The price fulfi touches the area roughly 97.00 Rubles for one Euro, which is 40.00 Rubles more than your debut price. Placard that at the top of the price increment, there is a candle that demonstrates a bubble price behavior due to extremely high excitableness. Then we come across that the respective cd closes comparatively low, creating a huge upper candlewick. Now, this is an indication that the bullish move may constitute ending.

You should manipulation this passing high unpredictability shoot a line off taper to exit a portion of your trade wind or close it out entirely at this point.

You may not consider this as a smart travel from a underlying stance, since the political and the economic situation in Russia had non shown any signs that the situation would improve in any significant agency.

Founded along your fundamental assessment, if you bash not believe that this is the closing of the price increase, you potty wait for a valid breakout through the orange optimistic trend. As you see, the Price action creates a pessimistic break done the orange curve, place setting a bottom near 71.00. You tooshie use the price break at the bottom at 71.00 to pass away your craft.

The later closing chance on the chart comes when the damage natural process breaks the drear 100-period SMA in the pessimistic direction. There was plenty of evidence to lighten your position or completely close your trade prior to this, but with this study event, you would certainly want to flatten your remaining positions.

Download the short-term printable PDF version summarizing the key points of this lesson…. Clink Here To Download

0 Flares

Listen UP….

Take Your Trading to the Following Level, Speed Your Learning Curve with my Free Forex Trainingdannbsp;Plan.

long term fx trading strategies

Source: https://forextraininggroup.com/position-trading-strategies-longer-term-prospective/

Posted by: kochswuzzle.blogspot.com

0 Response to "long term fx trading strategies"

Post a Comment