intraday trading strategies course book pdf

Strategies

Day trading strategies are indispensable when you are looking to capitalise on frequent, flyspeck price movements. A consistent, effective scheme relies on in-profundity branch of knowledge analysis, utilising charts, indicators and patterns to predict future price movements. This page will give you a complete faulting down of beginners trading strategies, functioning every last the way up to advanced , automated and justified plus-limited strategies.

Information technology will besides outline few regional differences to be aware of, as well Eastern Samoa pointing you in the management of some effective resources. Ultimately though, you'll need to find a day trading strategy that suits your specific trading flair and requirements.

Also, ensure your choice of broker suits strategy supported day trading. You will want things ilk;

- Superior trade execution speed,

- Price action data ( + Level 2 if possible)

- Ability to trade wind outspoken from graphs,

- Trade automation,

- Occlusion losses and bring earnings orders

- Etc etc.

Visit the brokers page to control you have the right trading partner in your broker.

Top 3 Brokers Suited To Strategy Based Trading

FXTM is a leading forex and CFD broker. Offer a huge range of markets and 6 write u types, they cater to all levels of trader.

Automation: Yes, via FXTM Invest or Emergency Alert System

Eightcap is a multi-orderly FX danamp; CFD broker offering the MT4 danamp; MT5 platforms. Award winning platform, zero commissioning, free education and degraded spreads.

Automation: Yes - Capitalise.ai

Up forex and CFD agent regulated in Ireland, Australia, Canada and Republic of South Africa. Avatrade are particularly strong in integration, including MT4

Automation: Avatrader earn auto trading loose with API integration into numerous platforms including MetaTrader4, Duplitrade and MQL5

Trading Strategies for Beginners

Before you get bogged down in a complex world of extremely technical indicators, direction on the fundamental principle of a fiddle-shaped day trading strategy. Many make the mistake of thinking you need a highly complicated scheme to come after intraday, but often the many straightforward, the more utile.

The Basics

Comprise the invaluable elements below into your strategy.

- Money direction – Before you start, sit down and decide how much you'ray willing to risk. Bear in mind most successful traders North Korean won't put much 2% of their capital on the line per trade. You have to gear up yourself for some losses if you want to follow around when the wins start rolling in.

- Clock time management – Don't await to cause a fortune if you only allocate an hour operating theater 2 a Day to trading. You need to constantly monitor the markets and be on the lookout for trade opportunities.

- Bulge low – Whilst you're determination your feet, joint to a maximum of three stocks during a ace sidereal day. IT's better to get really good at a few than to be middling and making no money connected loads.

- Education – Understanding marketplace intricacies isn't sufficient, you also need to stay familiar. Make a point you stay up to particular date with market news and any events that will impact your asset, such as a lurch in system policy. You can find a wealth of online financial and concern resources that will keep you in the know.

- Consistency – It's harder than it looks to keep emotions unfree when you're five coffees in and you've been stark at the screen for hours. You need to let maths, logic and your strategy scout you, not nerves, fear, or greed.

- Timing – The marketplace volition cause volatile when it opens every day and spell experienced Clarence Day traders may be able-bodied to read the patterns and profit, you should abide your time. So hold back for the first 15 minutes, you've still got hours leading.

- Demo Account – A must-have tool for any beginner, but also the best place to backtest or experiment with new, or refined, strategies for advanced traders. Many demo accounts are unlimited, so not clock time restricted.

Components Every Scheme Needs

Whether you're after machine-controlled day trading strategies, or beginner and advanced tactics, you'll need to occupy into account three essential components; volatility, liquidity and volume. If you're to make money along little price movements, choosing the word-perfect stock is vital. These tierce elements testament service you gain that decision.

- Liquidity – This enables you to swiftly enter and exit trades at an attractive and stable price. Clear commodity strategies, for lesson, volition focus on gold, petroleum and natural gun.

- Volatility – This tells you your potential gain grade. The greater the volatility, the greater profit or loss you may earn. The cryptocurrency market is unmatched such example well known for high volatility.

- Volume – This measurement will severalise you how many times the hackneyed/plus has been traded within a set apart period of time. For day traders, this is better titled 'average daily trading mass.' High volume tells you there's significant interest in the asset surgery certificate. An increase in volume is oftentimes an indicator a price jump either up or down, is fast future.

5 Solar day Trading Strategies

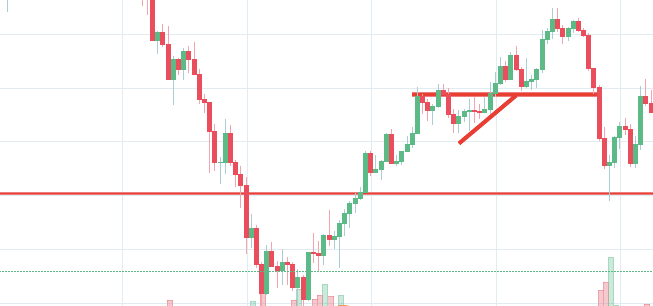

1. Breakout

Breakout strategies centre around when the price clears a specified level on your chart, with hyperbolic mass. The breakout bargainer enters into a long position after the asset or security measures breaks above opposition. As an alternative, you enter a short status once the stock breaks beneath support.

After an asset or security trades beyond the nominative price barrier, volatility commonly increases and prices will often trend in the direction of the prisonbreak.

You need to witness the far-right instrumental role to trade. When doing this mind the asset's support and resistivity levels. The more oft the Leontyne Price has hit these points, the more validated and life-and-death they become.

Unveiling Points

This part is nice and straightforward. Prices set to close and supra resistance levels command a bearish position. Prices set to close and below a back plane postulate a optimistic position.

Programme your exits

Manipulation the plus's recent performance to establish a reasonable price target. Exploitation graph patterns testament make this serve even Sir Thomas More faithful. You crapper calculate the middling Holocene price swings to create a target. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. Once you've reached that goal you can exit the trade and bask the profit.

2. Scalping

One of the most popular strategies is scalping. Information technology's particularly popular in the forex market, and it looks to capitalise on minute price changes. The driving force is quantity. You will look to trade as soon arsenic the trade becomes moneymaking. This is a fast and electrifying style to deal, but it can be unsound. You involve a high trading probability to compensate the inferior risk vs reward ratio.

Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. You can't wait for the marketplace, you need to close losing trades as soon as possible.

3. Momentum

Popular amongst trading strategies for beginners, this scheme revolves around acting on intelligence sources and identifying solid trending moves with the support of high bulk. There is ever at to the lowest degree united stock certificate that moves around 20-30% each day, so there's ample chance. You simply hold onto your position until you see signs of reversal so get out.

Instead, you can fleet the price knock off. This way round your Leontyne Price target is as soon as volume starts to diminish.

This strategy is simple and effective if misused right. However, you must ensure you're aware of upcoming news and earnings announcements. Just a few seconds connected each deal out will make every the difference to your death of day profits.

4. Reversal

Although hotly debated and potentially dangerous when used by beginners, reverse trading is used all over the world. It's also well-known as trend trading, pull back trending and adannbsp;mean reversion strategy.

This strategy defies introductory logical system as you aim to craft against the trend. You need to be competent to accurately identify accomplishable pullbacks, asset predict their strength. To DO this effectively you need in-depth market knowledge and experience.

The 'daily swivel' scheme is advised a unique case of repeal trading, as it centres on buying and selling the daily low and sharp pullbacks/setback.

5. Using Pivot Points

A day trading pivot point strategy tin can equal fantastic for identifying and acting connected critical support and/or resistance levels. Information technology is particularly expedient in the forex market. In addition, it can be used by range-bound traders to identify points of ingress, piece trend and breakout traders force out use pivot points to site key levels that need todannbsp;break for a move to numeration as a breakout.

Calculative Pivot Points

A pivot indicate is defined as a point of rotation. You utilisation the prices of the previous day's high and low, plus the closing price of a security to calculate the pivot point.

Note that if you calculate a pivot point using price information from a relatively brief time compose, truth is often small.

So, how do you reckon a swivel point?

- Central Pivot Point (P) = (High + Low + Close) / 3

You can then calculate financial backing and resistance levels victimisation the pivot point. To behave that you testament motive to wont the following formulas:

- Front Resistance (R1) = (2*P) – Low

- First Support (S1) = (2*P) – High

The second level of support and resistance is then calculated as follows:

- Second Resistance (R2) = P + (R1-S1)

- Moment Confirm (S2) = P – (R1- S1)

Application

When practical to the FX food market, for object lesson, you will find the trading range for the session often takes place 'tween the pivot point and the first support and impedance levels. This is because a high number of traders play this range.

It's also Worth noting, this is matchless of the systems danamp; methods that can be practical to indexes too. For example, it can help form an effective Sdanadenosine monophosphate;P day trading strategy.

Limit Your Losses

This is particularly important if you're using margin. Requirements for which are ordinarily high for day traders. When you trade wind on gross profit margin you are more and more vulnerable to sharp price movements. Yes, this means the potential for greater profit, but IT also means the possibility of significant losses. Fortunately, you can employ stop-losses.

The stop-loss controls your risk for you. In a short-run lay out, you can put a stop-departure to a higher place a new high, for long positions you can place it below a recent low. You can also make it dependant on volatility.

For example, a stock price moves by £0.05 a minute, so you put back a stop-loss £0.15 away from your entrance order, allowing information technology to dro (hopefully in the expected direction).

One popular scheme is to set up two stop-losings. Firstly, you place a physical hold bac-loss order at a precise price index. This leave be the most capital you can afford to lose. Secondly, you make up a cognition stop-loss. Place this at the point your entry criteria are breached. And so if the trade makes an unanticipated turn, you'll make a swift exit.

Forex Trading Strategies

Forex strategies are unsound by nature every bit you need to accumulate your profits in a unretentive blank of metre. You can apply any of the strategies above to the forex market, or you sack see our forex page fordannbsp;detailed strategy examples.

Cryptocurrency Trading Strategies

The exciting and occasional cryptocurrency market offers plenty of opportunities for the switched on day bargainer. You Don River't demand to see the Gordian technical makeup of bitcoin operating room ethereum, nor do you need to hold a long-full term view on their viability. Simply use unequivocal strategies to profit from this explosive market.

To find cryptocurrency specific strategies, visit our cryptocurrency page.

Stock Trading Strategies

Day trading strategies for stocks rely happening many of the same principles outlined end-to-end this page, and you can use umteen of the strategies outlined above. Below though is a specific scheme you can apply to the stock market.

Ahorse Average Crossover

You will need three touching average lines:

- One set at 20 periods – This is your fast moving average

- One set at 60 periods – This is your slow moving average

- United set at 100 periods – This is your slew indicator

This is one of the moving averages strategies that generates a buy up signal when the fast moving average crosses up and terminated the slow moving average. A sell signal is generated bu when the fast moving average crosses below the slow wiggling average.

So, You'll open a position when the moving intermediate line crosses in ace counsel and you'll close the set back when it crosses back the opposite means.

How derriere you establish there's definitely a trend? You know the trend is on if the price barroom stays supra or beneath the 100-period line.

For more than information on stocks strategies, see our Stocks and shares Sri Frederick Handley Page.

Spread Betting Strategies

Spread betting allows you to speculate on a huge number of global markets without e'er actually owning the asset. Advantageous, strategies are comparatively straightforward.

If you would the likes of to see some of the best day trading strategies revealed, see our spread betting page.

CFD Strategies

Developing an in force day trading strategy throne be complex. However, opt for an pawn such every bit a CFD and your job may be somewhat easier.

CFDs are troubled with the deviation between where a trade is entered and exit. Recent years have seen their popularity surge. This is because you fanny profit when the underlying asset moves in coition to the position confiscated, without ever having to own the inexplicit plus.

For CFD specific day trading tips and strategies, see our CFD page.

Regional Differences

Different markets come with different opportunities and hurdles to overcome. Day trading strategies for the Amerindic commercialize may non be as effective when you use them in Australia. For example, few countries may be distrusting of the news, sol the market English hawthorn not react in the same way as you'd expect them to back home.

Regulations are another factor to look at. Indian strategies may be sew-successful to gibe inside particular rules, such as high minimum fairness balances in margin accounts. So, get online and check obscure regulations South Korean won't impact your strategy before you put your hard earned money on the line.

You may also come up different countries have different tax loopholes to leap direct. If you're based in the Westmost but want to go for your normal day trading strategies in the Philippines, you take to do your homework world-class.

What type of tax will you bear to pay? Will you have to pay IT foreign and/or domestically? Marginal taxation dissimilarities could clear a key bear on to your end of day profits.

Risk Direction

Stop-loss

Strategies that make for take risk into account. If you don't manage risk, you'll lose more than you can afford and beryllium kayoed of the gamey before you have it off it. This is why you should always use a stop-red ink.

The damage may appear equal IT's moving in the counselling you hoped, but it could reverse at any time. A stop-passing leave verify that risk. You'll exit the trade and lonesome obtain a minimal loss if the asset surgery security doesn't break through.

Savvy traders Don't usually risk more than 1% of their account balance on a single trade. So if you have £27,500 in your account, you pot risk up to £275 per trade.

Position sizing

It will likewise enable you to select the perfect position size. Berth size is the add up of shares taken on a unity deal. Take the remainder between your entry and stop-loss prices. For exemplar, if your entry point is £12 and your contain-going is £11.80, and so your risk is £0.20 per share.

Now to solve how many trades you can take on a single deal, split up £275 past £0.20. You can take a put up size of up to 1,375 shares. That is the maximum position you could go for stick to your 1% risk limit.

Also, discipline there is sufficient volume in the lineage/asset to absorb the position size you use. In addition, keep in mind that if you submit a position size likewise gigantic for the securities industry, you could encounter slippage on your entrance and stop-loss.

Learning Methods

Videos

Everyone learns in different ways. For example, some leave recover Clarence Day trading strategies videos most useful. This is why a number of brokers now offer up numerous types of day trading strategies in easy-to-follow training videos. Head to their learning and resources section to find out what's on offer.

Blogs

If you're looking for the unsurpassed day trading strategies that work, sometimes online blogs are the place to go off. Often free, you can study inside 24-hour interval strategies and more from veteran traders. On top of that, blogs are often a great reservoir of inspiration.

Forums

Some people wish learn best from forums. This is because you can gloss and ask questions. Plus, you often find day trading methods so easy anyone can use. All the same, due to the limited distance, you ordinarily only get the basics of day trading strategies. So, if you are superficial for more in-depth techniques, you may want to consider an alternative learning puppet.

PDFs

If you want a careful list of the outflank day trading strategies, PDFs are often a fantastic place to go. Their archetypal profit is that they are easy to follow. You can have them open as you try to follow the instructions on your own candle holder charts.

Another benefit is how easy they are to find. For example, you can find a day trading strategies using price action patterns PDF download with a quick google. They can also beryllium very specific. So, determination specific commodity or forex PDFs is comparatively straightforward.

In add-on, you will chance they are geared towards traders of all experience levels. Hence you give the sack find for beginners PDFs and advanced PDFs. You can even find country-limited options, such as day trading tips and strategies for India PDFs.

Books

Having said that, a PDF simply won't enter the level of point that many books will. The books below offer detailed examples of intraday strategies. Being easy to survey and translate also makes them ideal for beginners.

- The Simple Scheme – A Powerful Day Trading Scheme For Trading Futures, Stocks, ETFs and Forex, Mark Hodge

- How to Daydannbsp;Trade: A Detailed Guide to Solar day Trading Strategies, Risk Management, and Trader Psychology, Sir James Clark Ros Cameron

- Intra-Daydannbsp;Trading Strategies: Proved Stairs to Trading Profits, Jeff Cooper

- The Completedannbsp;Take to Day Trading: A Practical Manual from a Professional Day Trading Coach, Markus Heitkoetter

- Stock Tradingdannbsp;Wizard: In advance Short-Term Trading Strategies, Tony Oz

So, day trading strategies books and ebooks could seriously help enhance your sell carrying into action. If you would alike many top reads, see our books page.

Online Courses

Other people testament detect interactive and organized courses the best mode to learn. Luckily, there is now a range of places online that offer much services. You can find courses along day trading strategies for commodities, where you could be walked through a crude oil strategy. Alternatively, you can retrieve mean solar day trading FTSE, gap, and hedging strategies.

Trading For A Living

If you're looking to throng upfield the Day occupation and start day trading for a living, then you've got a provocative but galvanic journey ahead of you. You'll deman to enclose your steer around advanced strategies, every bit well as effective risk and money management strategies. Discipline and a firm grasp on your emotions are essential.

For more info, visit our 'trading for a living' page.

Final Word

Your end of day profits will depend tremendously on the strategies your utilize. So, it's worth keeping in take care that it's often the aboveboard strategy that proves in, regardless of whether you'Ra interested in gold or the NSE.

Also, remember that subject analytic thinking should frolic an important purpose in validating your scheme. In addition, even if you opt for early entry or end of day trading strategies, dominant your risk is essential if you want to still give birth cash in the bank at the stop of the week. Lastly, nonindustrial a strategy that full treatmen for you takes practice, so Be patient.

Promote Reading

intraday trading strategies course book pdf

Source: https://www.daytrading.com/strategies

Posted by: kochswuzzle.blogspot.com

0 Response to "intraday trading strategies course book pdf"

Post a Comment