How To Spot Trends In Forex

Through my xv+ years experience in trading, I take discovered that when it comes to identifying the trend of a marketplace, there is no magical tool, no indicator and no ready of rules that always piece of work. As traders, despite our best efforts to clarify the charts and carefully make up one's mind a bias on the charts and trade in-line with the trend of the market, ultimately the direction of the market can quickly change at any time. If things don't go to plan, nosotros should utilize the benefit of hindsight analysis to dissect the chart and figure out what we initially missed and what went wrong. Just recall that this isn't an verbal science, and sometimes, despite our best efforts to make sense of the charts, the market will just move in the contrary management. Don't beat yourself up.

Through my xv+ years experience in trading, I take discovered that when it comes to identifying the trend of a marketplace, there is no magical tool, no indicator and no ready of rules that always piece of work. As traders, despite our best efforts to clarify the charts and carefully make up one's mind a bias on the charts and trade in-line with the trend of the market, ultimately the direction of the market can quickly change at any time. If things don't go to plan, nosotros should utilize the benefit of hindsight analysis to dissect the chart and figure out what we initially missed and what went wrong. Just recall that this isn't an verbal science, and sometimes, despite our best efforts to make sense of the charts, the market will just move in the contrary management. Don't beat yourself up.

To exist clear, tendency analysis is only one part of the overall trading strategy I employ to enter and leave trades. It is never a adept idea to enter a trade based on i factor alone, which is why I await for as much prove as possible to confirm a trade. In my ain trading plan, I employ a concept known as T L S confluence, an assay technique which brings together; trend analysis, level analysis, and signal assay.

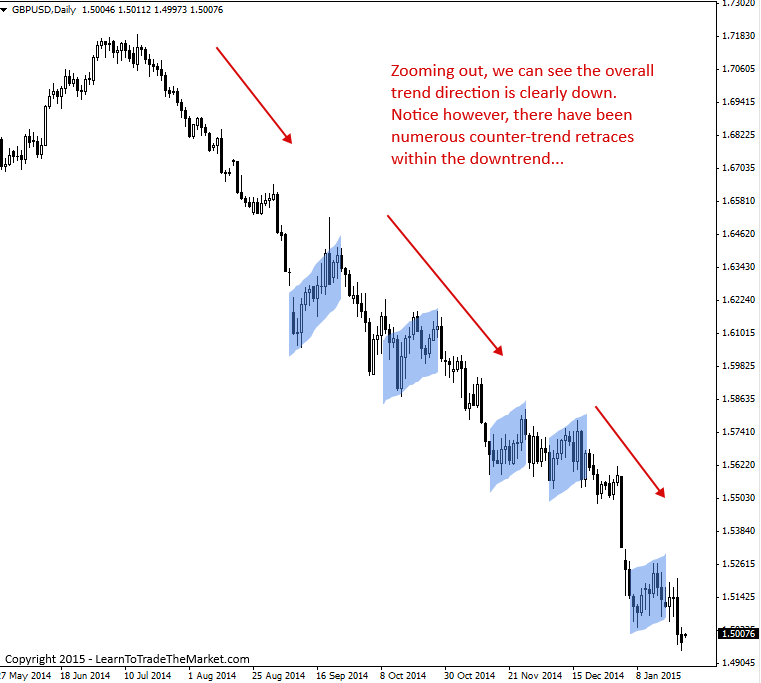

When reading today's lesson, continue in mind, I am not talking almost "trading the tendency" here, I am just providing a ready of filters and observations to identify the most obvious direction the market place is likely to head. Also, the market place may wait like it's trending in one direction, when in fact it's really trending in the other direction. This is because many markets experience brusque-term retracements, which tend to deceive traders. For this reason, always zoom out and look at the bigger picture on the charts and and then zoom in and drill down from in that location.

We volition starting time with the simpler techniques and work our way to the more than advanced techniques.

i. Visual observation is key.

The get-go matter to understand well-nigh tendency identification is that it is not a perfect scientific discipline. I endeavor to keep information technology as simple as possible and I outset off by just visually observing a bare price activeness nautical chart, with no indicators.

If you lot ask different traders, you will hear different versions of what the current trend of a market is. Some will give you the brusk-term trend, some the long-term and some the mid-term. However, the virtually important trend to place is the almost obvious current dominant daily chart trend. We can identify that using both brusk-term and long-term assay, which begins past just observing the charts.

I like to ask myself, what is the chart looking like over the terminal year or two, 6 months and 3 months? That shows me the long-term, mid-term and short-term views, respectively. Doing this gives me a very clear idea of the overall chart direction moving from left to right. If all else fails, zoom out on a daily or weekly nautical chart and take a pace back and just inquire yourself, "Is this chart falling or rising?". Don't over complicate it!

By taking a look at the general direction of the price action in a market over the concluding 3 month to i year, we can easily see whether information technology's generally trending up, down or even sideways.

2. Identify the almost obvious swing highs and lows.

Every bit markets tendency, they go out backside swing points on a chart. By paying attention to these swing points we can apace see which mode a market is trending.

In the chart beneath, find we take a clear uptrend in identify in the Southward&P500, something we have been discussing for months at present in our recent S&P500 market commentaries. Notice the highlighted areas, these are swing lows within the uptrend and if you just focus on those highlighted areas you will come across they form 'steps', stepping higher as the marketplace moves in the management of the tendency…

Note, in a down-trending market you'd be more focused on swing highs and seeing if they are creating a stepping pattern to the downside.

iii. College Highs, Higher Lows, Lower Highs and Lower Lows

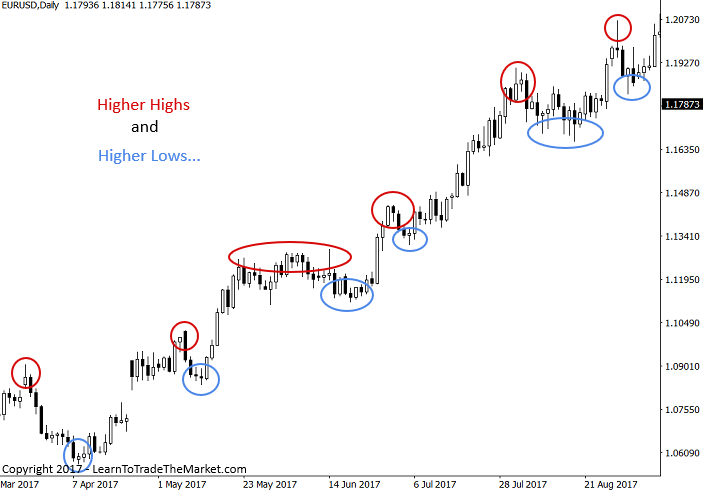

In one case you have drawn in the obvious swing points on the chart, you can then determine if the market is making HH and HL or LH and LL: HHHL – Higher Highs and Higher Lows, LHLL – Lower Highs and Lower Lows.

Generally, in an uptrend you will see a fairly obvious pattern of HH and HL from the market'due south swing points, and in a downtrend you will see a fairly obvious pattern of LH and LL from the market'southward swing points. We can run across an uptrend was in place in the chart below, as you can see from the articulate design of higher highs and higher lows…

4. Is the market appearing to 'bounce from value'?

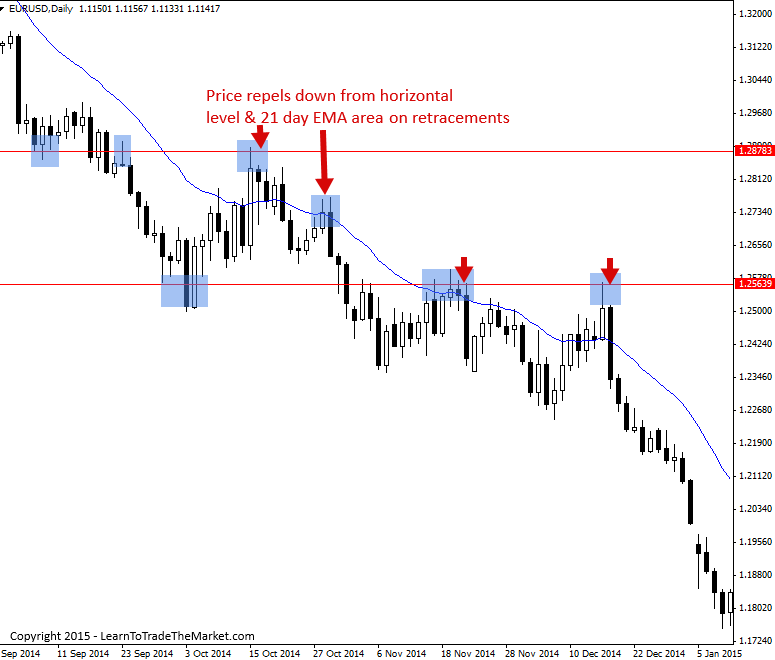

Check the behavior of the price activeness afterwards retraces and check information technology as it approaches the long-term moving averages such every bit 21 day ema (exponential moving average) or a key horizontal resistance level. Does the price action repel down equally in a downtrend or bounce upward equally in uptrend? This kind of toll beliefs is a good inkling to confirm the underlying bias / trend of the market place.

In the chart above, we can meet that all retraces higher to both horizontal resistance levels and the 21 twenty-four hour period EMA were met with selling pressure every bit the dominant downtrend remained intact.

Put a 200 and fifty day ema on your chart and cheque out the long-term slope of these ema's. This is a skillful quick way to identify the overall dominant tendency of a market place. Yous should look at how prices are reacting near the moving averages (value zone), if the price is respecting those EMA levels and repelling/bouncing abroad from them on several occasions, you have good evidence the market place is trending (a concept I phone call a 'perfect trend' and expand on in more than more detail in my price action trading courses). The chart below is a corking case for theory purposes, merely don't await to encounter this every day.

Discover in the chart above, the l and 200 menstruation EMA's requite u.s.a. a good quick-view of the dominant daily chart tendency direction.

5. Are there price action signals forming?

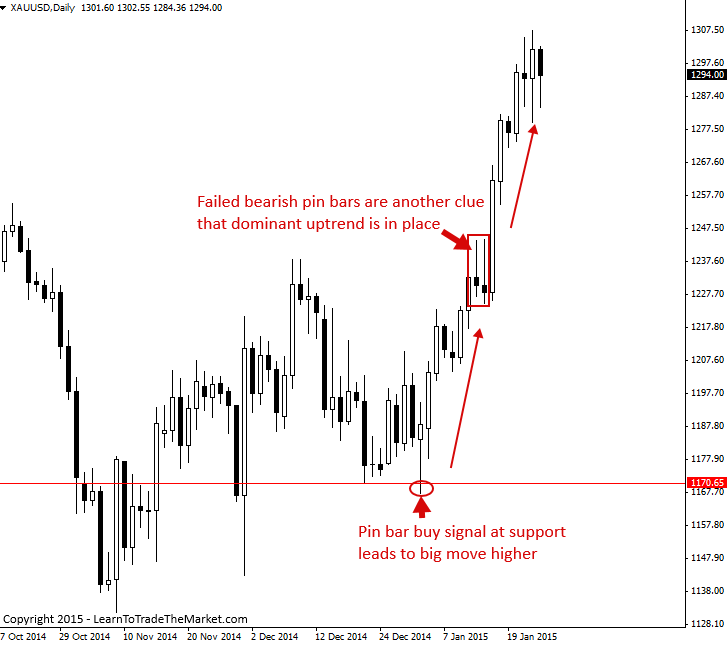

If you see price action signals that are producing substantial movement in-line with the trend, this is another confirming factor for your directional bias on a market. Also, think that repetitive failed price activity signals suggest the market place is going the other way (and possibly irresolute trend).

In the nautical chart higher up, notice how the bullish pin bar at support really kicked off the uptrend which was again 'confirmed' by the failure of the surly pin confined.

6. Modify in trend direction

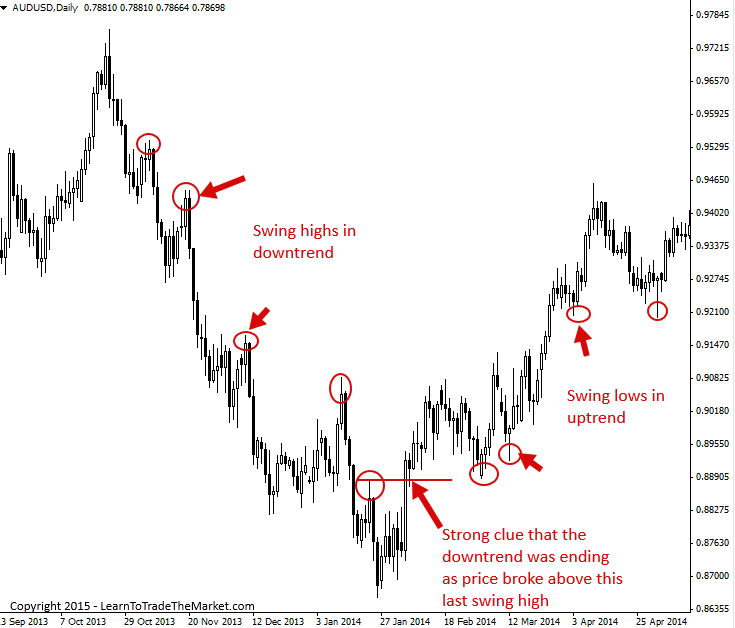

If a market is trending lower, we want to pay shut attention to the recent swing highs, and in an uptrend we will focus on the contempo swing lows. We do this considering it not only shows us the overall trend, but information technology also shows u.s.a. via the price action if the trend is still intact or not.

For case, if yous take a series of Higher Highs and Higher Lows equally in an uptrend, when you see price intermission downward past the previous swing low, it'south a strong indication that the uptrend might exist ending. Conversely, in a downtrend we see Lower Highs and Lower Lows, and when cost breaks above the previous lower loftier, it's a strong indication that the downtrend might exist ending.

Decision

Once you are confident you have identified the trend / directional bias of a market, you lot then look for a signal or area / level of the chart to enter. Nosotros call that confluence and information technology's a concept that would require some other lesson to explicate, check out a lesson on trading with confluence hither.

Finding the market bias or trend is catchy, specially for beginning traders, and most traders will find this to be a sticking point in their trading evolution. Information technology's OK to understand various entry triggers and setups, but if you're trading against the dominant marketplace bias, your probabilities of making coin subtract dramatically. There is ever a bias, and as beginner traders especially, y'all would be well served to stick with it.

In my professional trading courses, I aggrandize in greater detail on how we identify and trade various forms of trends using price activity signals as confirmation.

I WOULD Dear TO HEAR YOUR THOUGHTS, PLEASE LEAVE A COMMENT Beneath :)

Whatsoever questions or feedback? Contact me hither.

Source: https://www.learntotradethemarket.com/forex-trading-strategies/6-tips-on-how-to-identify-the-trend-on-charts

Posted by: kochswuzzle.blogspot.com

0 Response to "How To Spot Trends In Forex"

Post a Comment